DLB Earnings Update: 2011-Q1

Posted on 22. Feb, 2011 by TheFreeInvestor in Stock Analysis, Valuation

In one of my previous posts, I wrote about my investment thesis for Dolby Laboratories (DLB). Recently, after the earning release of the first quarter of 2011, DLB stock price is down 15% to around $51-$52. What spooked the market was the downward revision of the revenue guidance for the year 2011 to $930 – $970 million, down by about $20 million compared to previous guidance. The slowdown in PC market was the driver behind the downward revision of the projections for 2011.

Thesis Check

The original long term outlook and thesis of this “tollgate” business in the audio entertainment arena remains intact. The slowdown in the PC market is a short term roadblock in the growth of Window 7 attach rates and other related licensing revenue for Dolby. Analysts attribute slowdown in the PC market to the popularity of tablets (iPad). Though Dolby has a tablet product, the margin on that is lower compared to PCs. We need to put this into perspective — Dolby has been a leader in audio technology since 1965. So, it has evolved from cassette players to CD players to DVD players to PCs, Blu-ray DVD, streaming, game consoles, and mobile devices etc. As you can see, the more entertainment proliferates into multiple devices, Dolby has been successfully penetrating those markets to generate licensing revenue. In that respect, I don’t think tablet market is any different. I think, it is a matter of time before they penetrate that segment too. As we have seen in many of the product evolutions, as the product matures (e.g., PCs), customers demand higher quality audio and Dolby provides that audio experience. To quote a few new sources of revenue — Dolby technology is used in XBox 360, PS3 game console and Netflix streaming video.

Apart from the licensing segment, the product segment has been thriving due to the surge in 3D products. Internationally, the Windows 7 attach rate is still a long way to go though piracy and low end PCs will continue to be roadblocks in the less developed markets. Similarly, HDTV rollout has a lot of distance to go in emerging markets.

The highlights of the recent quarter seems to be solid in my view and I am happy to add to my position at current prices. Though I still believe in the long term story, I have no idea how it will play out in short term. But, I am happy to hold my shares for long haul even if the stock stays low till we see some more clarity about PC growth rate in 2011 and how the tablet market is going to shape up.

Valuation

Here is a full blown DCF of Dolby after the recent quarterly results. Let me preface the analysis with the disclosure that, I use concepts and methods of Prof.Damodaran of New York University for DCF calculations.

1. DCF Inputs

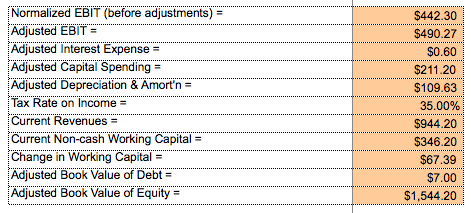

P&L items are stated as trailing twelve months (ttm) and balance sheet items are stated as of the latest quarter. Most of the adjustments are related to R&D capitalization and amortization.

Earning and Cashflows:

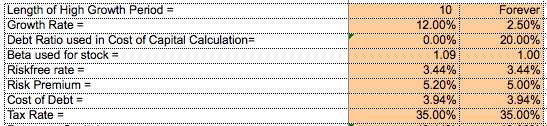

Growth and Discount Rate:

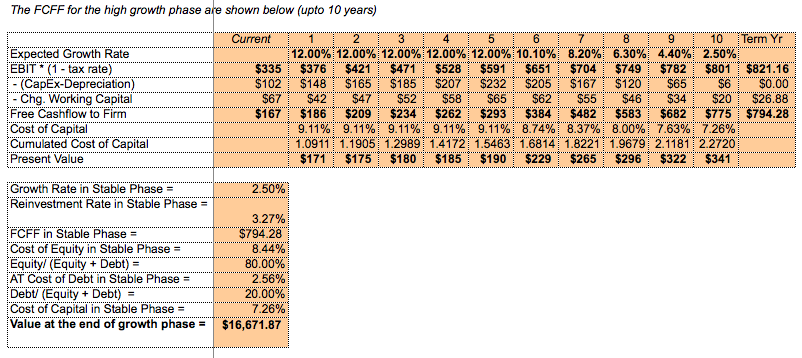

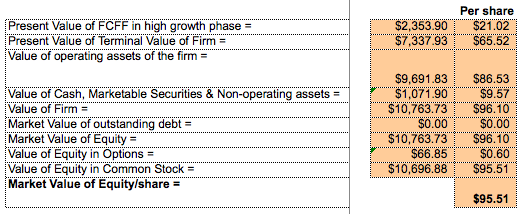

2. DCF Calculation:

[Note: Click on the table to see a larger view]

Some folks might think that my discount rates are too low. But, I believe, the rates reflect a fundamentally consistent and market neutral valuation given the low interest rate environment. One could argue that for a company with a significant presence in international markets, therefore, we should apply a country risk premium and usually I would concur. But, in case of Dolby, it is not a physical product, warehouse, inventory and factory type of business. So, I don’t see a need to add a country risk premium.

(Note: Top picture courtesy waynemah)

(Disclosure: As of the publication of this post, I hold long position in DLB. Please read the disclaimer at the bottom of this site.)